Many people consider taxes as a conception quite synonymous with complexity. Sometimes it can get so confusing that one might not know how much they owe to their country. Now let us put ourselves in the new residents’ shoes who just moved to Switzerland, feeling confused. How complicated must the tax system be to them? With that in mind, we’ve highlighted below a few important “must-knows” about the tax system in Switzerland.

Who Pays Taxes in Switzerland?

Before we get started with how much and the kind of taxes a Swiss resident is expected to pay, let’s take a brief look at who is obligated to pay taxes in Switzerland according to Swiss law.

Residents

This might seem like a no-brainer as all those who reside in a particular country are expected to pay a certain percentage to their government in taxes. However, what we want to know is who exactly qualifies as a tax-paying resident?

In Switzerland, a person who maintains a ‘tax domicile’ or a ‘tax residency’ becomes a resident for tax purposes. A tax domicile means that if you have been living and working for a long time in Switzerland and are considering living here permanently, you are eligible to pay taxes. On the other hand, a tax residency means that you have stayed for 30 days for a remunerative activity or a period of 90 days with no lucrative activity. Consequently, you are considered a resident for tax purposes.

To become a Swiss resident, one needs a permit. There are several types of permits and working visas, yet here we’ve highlighted three of the most important ones and how they’re categorized in the taxing system.

- Residence C permit – also known as ‘Settled Foreign Nationals.’ Those with this kind of permit have been living and working for up to ten years in Switzerland. With this permit, you are liable to pay taxes like a Swiss-born resident.

- Resident B permit – or the permit that resident foreign nationals have. This type of permit usually lasts for about five years if you have an unlimited employment relationship. However, if you stay unemployed for 12 months, then the permit might be limited to one year. For this type of residence, you will most likely also be paying taxes at the source.

- Residence L permit – or a short-term residence permit. This kind of permit typically lasts from 3 to 12 months. Usually, with this type of permit, you’re subjected to taxes at the source. That is to say that taxes will be deducted from the income.

Foreigners staying in Switzerland for medical purposes aren’t required to pay taxes. However, this doesn’t apply to those that move to Switzerland to get an education. As an international student working in Switzerland, you will be paying taxes held at the source. If you are a student with an L permit or B permit but not working, then you’ll be paying a residency tax.

What Kind of Taxes Are There?

Now that we’ve cleared up who pays taxes, let’s take a look at a few types of taxes you are most likely to pay in Switzerland. Depending on the canton and the residence permit you hold, the taxes can be paid in three installments, monthly or even annually. Besides the installments, the tax rate also depends on the canton you’re living in. That’s why you’re encouraged to consult your local tax office.

Income Tax

An income tax is exactly what it sounds like; you will pay taxes depending on your income. In other words, the rate depends on how much you earn. You can find the details for your tax payment within the statement of your annual salary. You pay this tax to the Swiss Confederation, canton, and commune.

Value Added Tax (VAT)

This type of tax applies to your purchases. When you purchase something, you pay VAT. The amount depends on the type of purchase. For instance, the tax rate for food is usually 2.5%, whereas other services typically are taxed with a 7.7% rate. Some services are VAT exempted. Museum tickets, cinema, concerts, rent are just some of them. Keep in mind that not all cantons pay VAT and that the VAT payment rate will also depend from canton to canton.

Tax at Source

People from other countries who work and get paid in Switzerland have their taxes withheld at the source. This means that your employer will be in charge of deducting the taxes from your salary.

Dog Tax

Dog owners have to pay a dog tax for keeping their dogs. Your commune or canton usually settles this. You need to register your dog within your commune, and you also need to let them know when you move between communes and everything that concerns your dog’s well-being. The rate for this tax depends on the canton. Some cantons take into consideration the size and the weight of the dog too.

Alcohol and Tobacco tax

Both imported and domestic alcoholic beverages are taxable. Imported alcoholic drinks are subject to monopoly taxes. Traditionally fermented beer, wine, and cider aren’t liable to this tax. Yet, beer as a beverage is subject to a beer tax that people need to pay to the Federal Customs Administration.

As for tobacco, manufacturers are responsible for paying for domestic tobacco products. The individual who deals with customs duties will be held accountable for the tax payment for imported tobacco products.

Gift Tax

Another tax that Swiss residents need to pay is the gift tax. Still, one thing that needs to be mentioned is that the one who pays this tax isn’t the one that buys it but the gift recipient. Don’t worry; despite being called the gift tax, personal and household gifts are exempt from this tax. This included gifts between partners, family members, and co-workers. This tax is usually imposed so that people won’t avoid ‘inheritance tax’ and won’t give away their property for free.

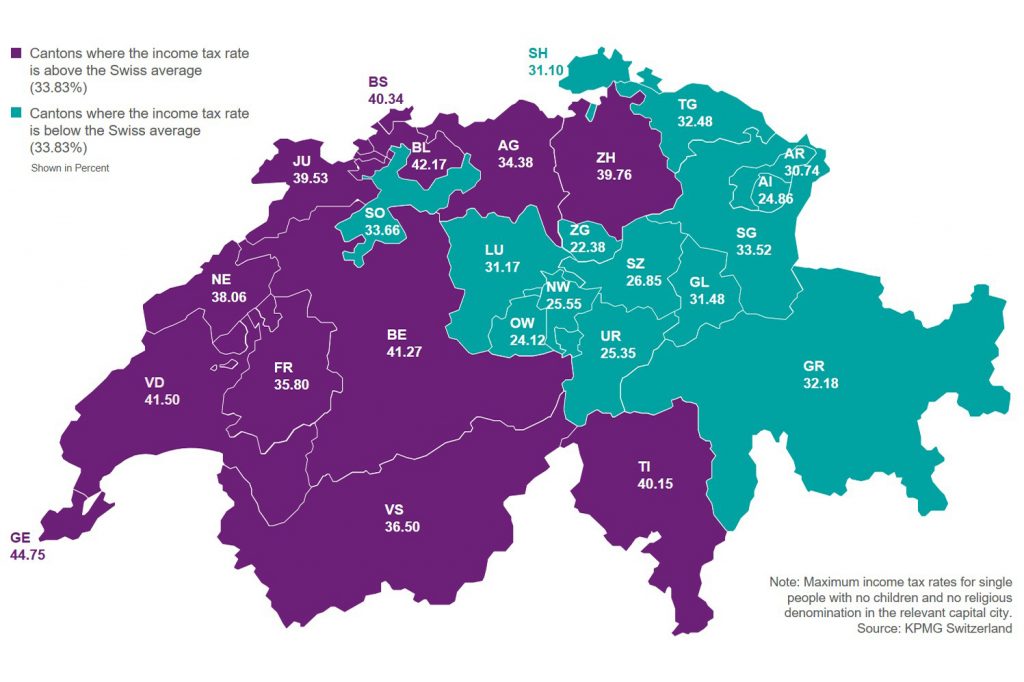

Cantonal Tax Rates

The Swiss Confederation is divided into 26 cantons. Each canton operates with its specific regulations. Some cantons have gained a reputation for being more relaxed tax-wise, while some are the opposite. For instance, some of the Swiss cantons with the highest tax rate are Geneva with 45,5%, Lausanne 41,5%, Zurich 39,7%, whereas Zug and Lucerne have lower tax rates at 22,8% and 31,1%. Though, tax rates can also depend on the individual’s circumstances, such as; marital status, employment, residency, and so on.

Calculate Your Taxes

There is an easy way to calculate the amount of taxes you have to pay. The Swiss government has thought of easing the process for its citizens by providing an online tax calculator. This means that you can determine how much you’ll pay in taxes in the comfort of your home.

In general, tax systems tend to be a bit complicated for everyone. However, the tax complexity intensity might be higher for those who recently moved to Switzerland. We hope we included all that you need to know about taxes in Switzerland, and you eventually get the hang of it.